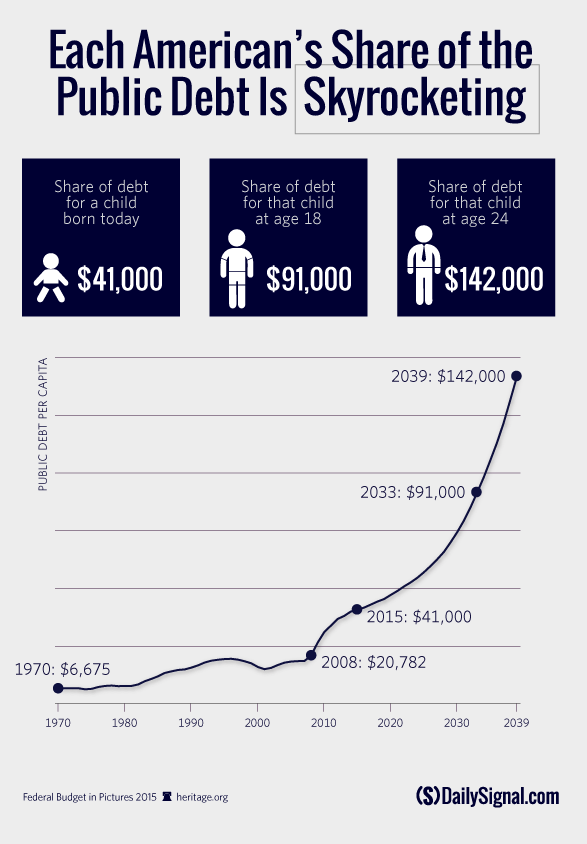

Today, on March 16, the debt limit returned at $18.1 trillion in total national debt. The largest share of this debt—$13 trillion—comes out to $41,000 for every individual living in the U.S. today.

This debt is called the public debt, which means that the government has sold this debt in credit markets to investors in the U.S. and abroad, including China, Japan and European nation countries. The remaining $5 trillion of national debt are debt the government has borrowed from dedicated trust funds, like the Social Security trust fund.

Children born in the U.S. this year would see their share of the public debt burden grow by more than $100,000, to top $142,000, by the time they graduate from college if Congress fails to solve the spending and debt crisis.

Staying on the current fiscal course is deeply irresponsible towards the next generation. Extensive research shows that excessive debt burdens harm job growth and reduce Americans’ personal incomes. Unless America changes course soon, the next generation will inherit a massive national debt and a less prosperous nation.

Check out the 2015 Federal Budget in Pictures for more charts on spending, debt, and taxes today! [http://www.heritage.org/federalbudget/]

"The Breakdown of Where Your Tax Dollars Go" - Romina Boccia/ March 17, 2015; http://dailysignal.com/2015/03/17/the-breakdown-of-where-your-tax-dollars-go/

"House Conservatives Cite Obamacare Repeal as ‘Motivating Reason’ for Supporting GOP Budget" - Melissa Quinn / @MelissaQuinn97 / March 17, 2015; http://dailysignal.com/2015/03/17/house-conservatives-cite-obamacare-repeal-as-motivating-reason-for-supporting-gop-budget/

No comments:

Post a Comment