PLEASE PRAY: 1.) For the girls/women each day contemplating an abortion; the abortionists and their staff; the crisis pregnancy centers seeking to serve the women facing unplanned pregnancies. 2) For the passage of even more state laws that will effectively help to limit the number of abortions being performed. 3.)The defunding of Planned Parenthood that performs over 300,000 abortions (about 1/3 the toal) for profit and still receives almost 1/2 billion dollars in federal tax dollars. 4.) That one day America might finally pass a constitutional amendment promoting the Sanctity of Every Human Life - in effect oulawing both abortion and euthanasia. 5) For churches/Christians being pro-life- not just claiming to be but demonstrating it conclusively by their actiions.

----------------------------------------------------------------------NOTE: If you've been watching the news the past few days, you may have heard the uproar over the House initially deciding to postpone the vote on aid to the victims of Hurricane Sandy. Well, as usual, you probably noticed that nothing of WHY it was delayed was presented by the mainstream media. I hope you sensed something was wrong with such one-sided coverage. Sure enough, as you'll read below, there was a reason for the delay: there was enough pork added on for a Texas-size barbeque. Just business as usual for those catering to special interests! Truly disgusting!

"Taxes to Rise on Most American Workers" - By Amy Payne On January 2, 2013

Representative Nancy Pelosi (D-CA) called it “a happy start to a new year [1].” That probably tells you all you need to know about the fiscal cliff deal that passed the House last night.The bill—which President Obama has promised to sign, though he took off for Hawaii again after the vote—has a 10 to 1 ratio [2] of tax increases to spending cuts. This is the President’s version of a “balanced” approach.

In addition to tax increases [3] on Americans making more than $250,000 a year, the bipartisan deal will actually raise taxes on the vast majority of American workers. How? The payroll tax “holiday” has ended. The Wall Street Journal calculates that the “typical U.S. family earning $50,000 a year” will lose “an annual income boost of $1,000 [4].”

Meanwhile, the higher tax rates will hit small businesses and investors—which is grim news for a country in need of new jobs. “It is the small businesses that employ the most workers [5] who will pay the higher rates,” explains Heritage’s Curtis Dubay. “These tax hikes on investment will further dampen investment and result in even less job creation. This is more bad news for the 12 million unemployed Americans.”

While the President touted a “balance” of tax hikes and spending cuts, the truth is that the bill increases government spending [5] by about $330 billion.

Though Congress and the President have known for two years that they would have to do something about all the expiring tax rates, they waited until after the deadline had passed. This resulted in lawmaking for which “irresponsible” is not a strong enough word.

The Senate voted without knowing the cost of the bill—the Congressional Budget Office had not even had time to go through it.The legislation passed both chambers of Congress within a 24-hour period on a holiday, which meant that Members of Congress—much less the American people—did not have time to find out what was in the 157-page bill.

Business Insider notes that all of the new tax rates are “‘permanent [6],’ meaning that Congress would have to agree to change them. This is a big deal. Almost every fiscal agreement reached by Congress since the Bush tax cuts of 2001 has been scheduled to phase out at a future date.”

After all the damage this deal has done, Congress isn’t through yet. Well, this Congress is—the outgoing lawmakers make their exit on Thursday, and the new Congress will be coming in. It will face the real consequences of the across-the-board budget cuts to defense known as sequestration, which this deal postponed for two months.

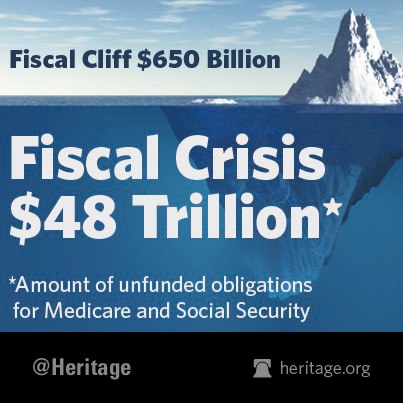

It will also face the U.S. debt limit. President Obama said last night that he is in no mood to get into another debt limit fight—even though that is inevitable.“While I will negotiate over many things, I will not have another debate with this Congress over whether they will pay the bills they’ve already racked up,” Obama said [7].But that debate is coming. This time, rather than grandstanding, Obama must deliver on his promise of a “balanced approach,” now that he has locked in his class warfare tax hikes.That means reforms to rein in entitlement spending in particular. The $650 billion fiscal cliff distracted from the $48 trillion looming fiscal crisis [8]—the long-term funding obligations of Social Security and Medicare.

Without spending cuts and real entitlement reforms, that fiscal iceberg remains dead ahead.

[9]

[9]Tweet this image [10]

[bold emhasis mine]

Quick Hits: Many conservatives have publicly criticized [11] the fiscal cliff deal.

Article printed from The Foundry: Conservative Policy News Blog from The Heritage Foundation: http://blog.heritage.org

URL to article: http://blog.heritage.org/2013/01/02/morning-bell-taxes-to-rise-on-most-american-workers/

URLs in this post:

you are invited to follow my blog

ReplyDelete